Tax Relief And Opportunities Through Renewable And Reliable Assets

About Us

Clearsun Power Is A Vertically Integrated Firm Specializing In Tax-Advantaged Renewable Energy Properties.

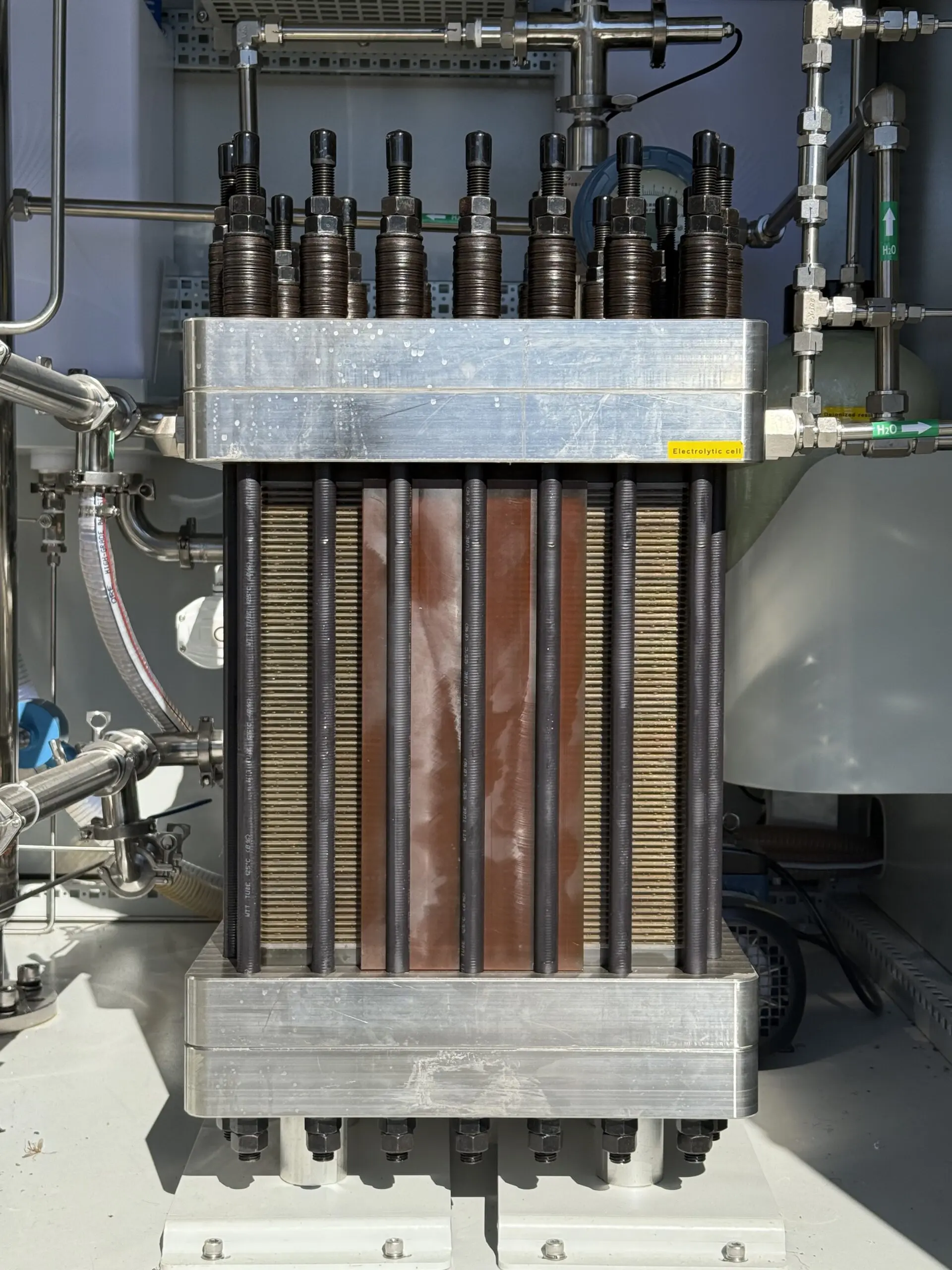

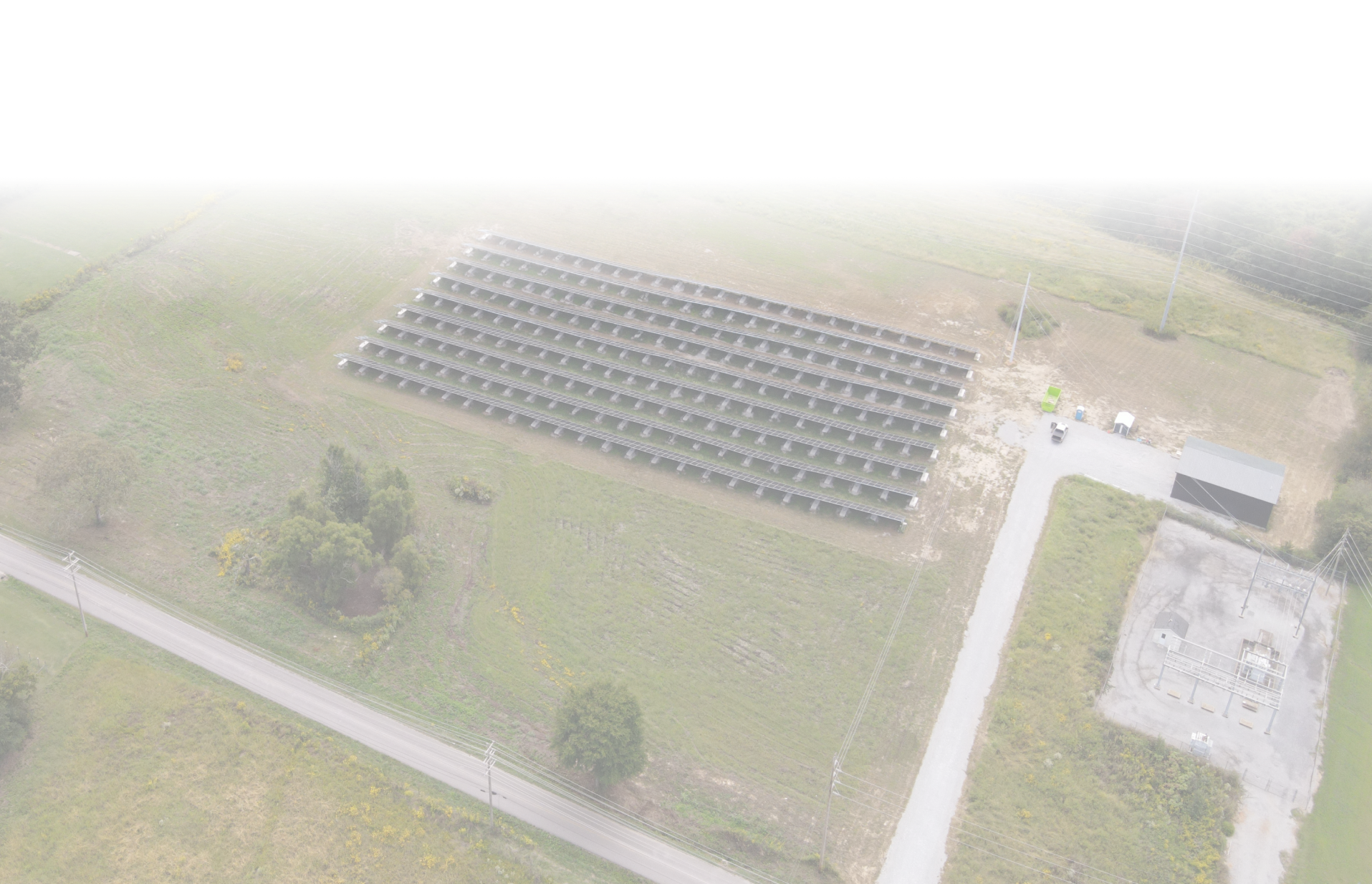

Our team of tax professionals structures compliant projects that generate income, tax credits, and bonus depreciation through projects under four key verticals: solar, hydrogen production, hydrogen storage and dispensing, and fuel cells. We don’t just advise on tax strategies—we develop the renewable energy properties that make them possible.

Get To Know Our CEO, Kent Salveson

Kent earned his LLM-Tax and a separate certification in estate and gift tax from Boston University. He has over four decades of expertise in law, construction, real estate, and finance, with a unique focus on utilizing tax incentives to drive transformative projects. He is a licensed attorney, contractor, and former real estate broker in California. Kent graduated from the University of Southern California with a B.S. in Biochemistry and J.D. from the University of La Verne.

What We Offer

Tax Relief Opportunities Through The Acquisition Of RGtax-Advantaged Assets That Generate Income, Tax Credits And Bonus Depreciation Across Several Asset Classes

Benefits

Clients typically realize approximately a 100% cash-on-cash return on down payment amount within the first year.

100%

Bonus Depreciation

40%

Tax Credit

+

Cashflow

Who We Serve

Maximize your after-tax returns through tangible, asset-backed investments. Clearsun Power helps high-income Individuals, LLC, Corporations, Trusts, Estates and Foundations reduce their tax liability attributable to tax credits and bonus depreciations.

The tax impact attributable to a one-time liquidity event can be managed through the purchase of Energy Storage Technology property. The EST property is allocated tax credits and depreciation which reduce taxable income and provide a dollar for dollar tax credit against tax owed.

An essential part of the strategy to protect generational wealth is tax mitigation. Trusts, Estates and Foundations are generally subject to a 40% tax rate. Asset growth and preservation can be enhanced through the purchase of Energy Storage Technology property which is allocated both a tax credit and depreciation which reduces taxable income and provides a dollar for dollar tax credit against taxes owed.

We invite collaboration with CPAs, tax attorneys, wealth managers and financial advisors to provide them the information necessary to assist their client in making the best financial or investment decision.

Who We Serve